Travel industry bets on orchestration to transform payments

Like other consumer‑facing industries, the travel sector has noticed that a smooth and efficient payments experience is essential to winning and retaining customers.

Our latest research ‘Travel Technology Investment Trends 2024’ took the pulse of payments leaders across the industry to understand their current challenges, investment plans and which payments capabilities they consider important in the coming few years.

The study found that 81% of travel businesses plan to increase or match their current level of investment in payments over the coming twelve months, with the average amount of money being made available to payments departments set to increase by 12%. This will be welcomed by payments professionals across the sector because they’re being asked to tackle a number of complex challenges.

Which payments problems are travel companies seeking to solve?

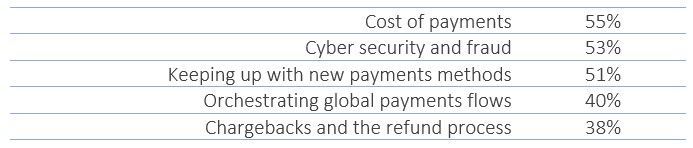

We asked payments professionals to choose their current challenges from a comprehensive list of options. Three ever-present issues compete for top spot.

Top challenges according to payments leaders in travel, are:

Several of these challenges are very familiar. Fraud is a continual game of cat and mouse to ensure payment systems remain resilient. The explosion of new payment methods is also well understood and many travel companies don’t yet have access to a flexible platform that can ease connectivity and acceptance of local payment methods. The cost of payments is always in focus as merchants seek to improve efficiency and optimize their supplier relationships. But orchestration appearing at number four caught my eye.

‘Orchestration’ caught my attention, here’s why

Just a few years ago there was little talk of orchestration at travel payments conferences but today it’s a primary focus of conversation. To see leaders from the industry cite challenges with orchestration above chargebacks is actually encouraging because it suggests our industry realizes the only way to reduce complexity is through orchestration. Indeed, more than a third of the respondents to our survey plan to implement a payments orchestration platform in the next 12 months.

Travel payments are uniquely complex. A large airline may operate in hundreds of markets and its passengers may wish to pay with hundreds of different methods, many of them local. The merchant is likely to have multiple acquiring partners covering its different geographic markets.

The nature of the airline’s sales also vary. Some bookings are arguably more important to the airline than others. A group booking of premium leisure travelers flying from the UK to the Maldives will make an outsized contribution to profitability. That’s not necessarily the case for an individual economy short-haul passenger. The way each payment transaction is processed behind the scenes needs to reflect this commercial reality.

The task for travel companies is to understand which payments partners they should task with handling their various different types of payments in order to maximize acceptance rates, reduce the cost of payments and to protect overall profitability.

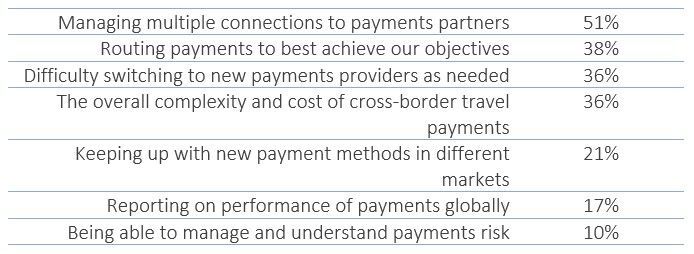

Our study dived more deeply into orchestration and cross-border payments. The results are interesting and suggest travel companies struggle to mitigate the complexities of cross-border payments flows in a global acceptance strategy.

Top challenges when managing cross-border payments:

Payments orchestration platforms that draw on deep travel and payments data assets can help to automate complex payments decisions, routing an airline’s transactions to the right local acquirer or fraud partner to achieve the best possible outcome. Such a platform also provides connectivity to multiple payments partners across the world through a single connection, reducing the integration burden.

When asked if they ‘orchestrate’ cross-border payments, just over a third of respondents say they already do this today (38%) with a further 30% planning to orchestrate their cross-border payments in the near future. Only 11% said they have no plans to apply payments orchestration.

Which payments capabilities are hot right now?

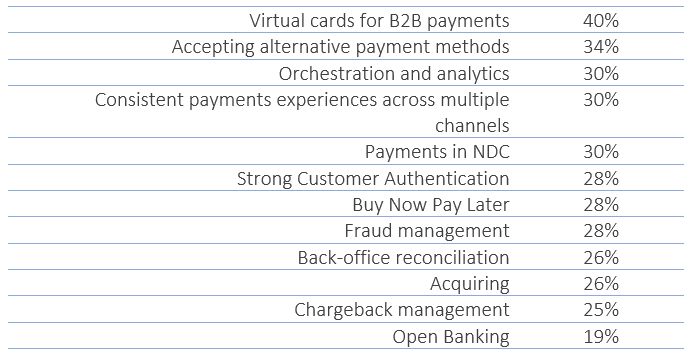

In addition to orchestration, travel payments leaders highlighted virtual cards for B2B payments, accepting alternative payment methods and delivering a consistent cross-channel payment experience as implementation priorities over the coming year. There are also a longtail of additional capabilities planned for implementation during 2024.

Payments capabilities travel companies will implement in the coming 12 months:

Of course, the ultimate objective for payments professionals is delivering a smooth and consistent multichannel payments experience so it’s encouraging to see 30% of travel companies investing in this ambition.

Digital native firms understand the consumer’s preferred payment method based on prior interactions, even when the customer shops across different channels like mobile, web or the call center.

Our survey asked travel payments leaders how close their organizations are to achieving multi-channel personalization of their payments experience by assigning a rating between one and five stars. Five stars signaled they’ve already achieved it.

Just 4% of respondents assigned their organization the full five star rating, with a weighted average across all respondents of 2.7 stars out of five. For an industry focused on achieving digital retailing excellence, this result suggests there is a significant opportunity to better align data and customer experience programs with payments capabilities.

Our study confirms that payments remains one of the most dynamic and fast moving areas of the travel industry as providers and sellers seek to gain competitive advantage by rolling out a wide range of new capabilities. Yet for an industry as global and complex as travel, payments leaders are also putting the right long-term foundations in place by focusing on payments orchestration.

TO TOP