Fraud uncovered: why it matters in travel and how we can reduce it

Travel is an inherently global industry and being able to effectively accept cross-border payments is an essential business enabler.

Travel companies that establish a global payments strategy are able to accept the correct payment methods across geographies to support business growth. Yet even when travelers can easily pay an airline, payments fraud can still be a significant barrier to business growth and pose a reputational risk.

Payments fraud occurs when a bad actor uses someone else’s payment details to book travel. Often criminals intend to cancel the booking and collect the refund to another card to obtain cash. Sometimes they intend to actually take the fraudulent trip.

Typically, this type of fraud isn’t the result of someone finding a lost credit card and attempting to book a trip. Unfortunately, it is usually more organized, with criminal gangs using lists of payment details obtained from hacks on businesses and individuals to practice fraud at an industrial scale.

Travel businesses must also contend with ‘friendly fraud’, which occurs when a legitimate customer raises a dispute to obtain a refund for a service that has been provided to a high standard.

Fraud management is an increasingly important practice that harnesses data analysis and machine learning technology to identify common types of fraud, like stolen cards, account takeovers, friendly fraud and chargeback abuse.

Geographical hot spots

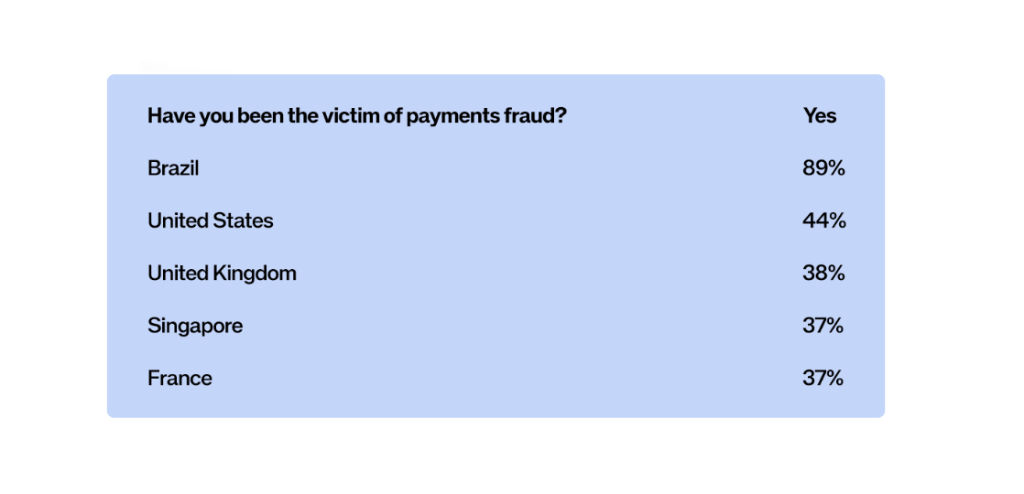

At Outpayce we recently conducted a survey with travelers from five geographical areas across the world and asked them if they have been the victim of payments fraud. On average, 50% (or one in every two respondents) have seen their payment method used to make fraudulent purchases, with significant territorial variations.

Perhaps unsurprisingly, at 89% more respondents from Brazil have been the victim of payments fraud than other markets, with the US slightly ahead of Singapore and the European markets included in our survey. This finding raises an important point. High rates of fraud in certain geographies can actually make it infeasible for travel companies to operate, restricting the industry’s growth in some of the most interesting and attractive parts of the globe.

The traveler's perspective

The travel industry remains a target for organized fraud rings due to the significant transaction values and cross-border nature of the industry. Indeed, a recent study from Juniper Research found that 46% of all payments fraud is targeted at the airline industry. This trend hasn’t escaped the attention of travelers, with 64% of respondents to our survey perceiving payments fraud to be increasing.

Travelers also place significant weight on the cyber security practices of their travel company. Indeed, 72% say a travel company’s strong reputation for secure commerce would encourage them to choose that firm over another provider with a less favorable reputation.

Our research explored this further by giving respondents the hypothetical choice between an airline that has invested in strong cyber security capabilities, and a second, that has not invested, but is prepared to offer a 5% discount. In our hypothetical example, the itinerary and service offerings of the two airlines were identical.

More than two-thirds of respondents said they would choose the airline with strong cyber capabilities and 26% opted for the airline offering a discount. Two-thirds were made-up of disproportionately older age groups and 26% by younger travelers, perhaps because they tend to be more price-sensitive. We followed this up by asking all travelers the average discount they’d require to fly with an airline where their payment details were less protected. On average, travelers told us they would require a whopping 38% discount to do so, underlining the value travelers now place on secure commerce.

The fightback

When it comes to payments fraud the travel industry is fighting back using ever more sophisticated technology to screen incoming payments for signs of fraud. Advanced fraud screening is all about spotting patterns, anomalies, and signs that an incoming payment could be fraudulent.

The ability to spot those signs requires a deep understanding about how people search for and book travel, combined with the payments and travel data assets upon which a rules-based engine and machine learning algorithms can be run.

For example, if a shopping session had the following characteristics, it would likely have a high fraud score:

- Immediately navigate to a premium flight without reviewing options

- Payment card details entered with a different pattern of keystrokes than is typical (fraud tools can remember how we tap the keys when entering our card number)

- The booking is unusual for the travel patterns of the card / card holder

- The shopping session was initiated from an IP address in a market associated with high rates of fraud

With the travel company assuming financial liability for any fraudulent purchases that do slip through it might seem sensible to screen out every transaction that raises a flag.

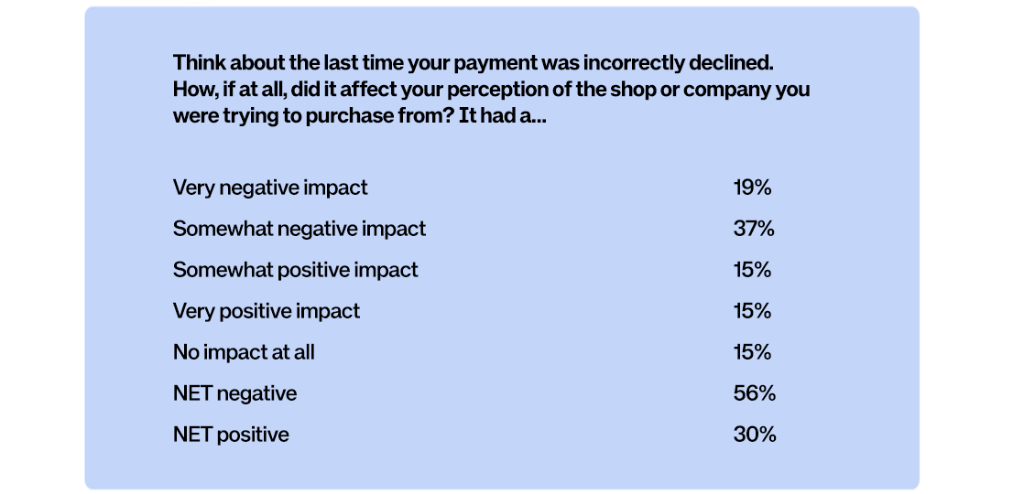

The problem is that any fraud management solution which is calibrated to be too sensitive risks increasing ‘false-positive’ rates. That is, when a payment is incorrectly identified as fraudulent and either sent for manual investigation or declined. In our latest research with travelers, two-thirds told us they have experienced payments being declined when making a genuine travel purchase.

This can be extremely costly for the industry, lowering payments acceptance rates and ultimately resulting in lost revenue as customers abandon the purchase.

At Outpayce we work with several leading fraud management partners that have developed advanced technology tailored specifically to fighting fraud in the travel industry. Our approach provides travel companies with a single point of integration to access multiple fraud management providers as well as access to rich travel data that can enhance fraud management. We help airlines to combine all security related processes, like authentication, fraud screening and pre-screening checks, helping to ensure maximum performance and efficiency.

Etraveli Group’s PRECISION solution is a good example of a fraud management solution recently made available through our platform. PRECISION has been fine-tuned over 20 years by screening payments worth many Billions of Euros across the group’s own consumer-facing travel sites.

One of the main advantages of this travel-specific experience is a highly accurate system, which can minimize the number of ‘false-positives’, supporting maximum conversion.

With travel companies seeking to expand their services to new markets and deliver a smooth payment experience the role of fraud management is rising in importance. With an effective program in place, travel companies are free to pursue growth without the risk that rates of fraud will be prohibitively high.

If you are interested in learning more on payments security, please stay tuned for our soon-to-be-released report, which dives deeper into these issues.

TO TOP